Increasing profitability.

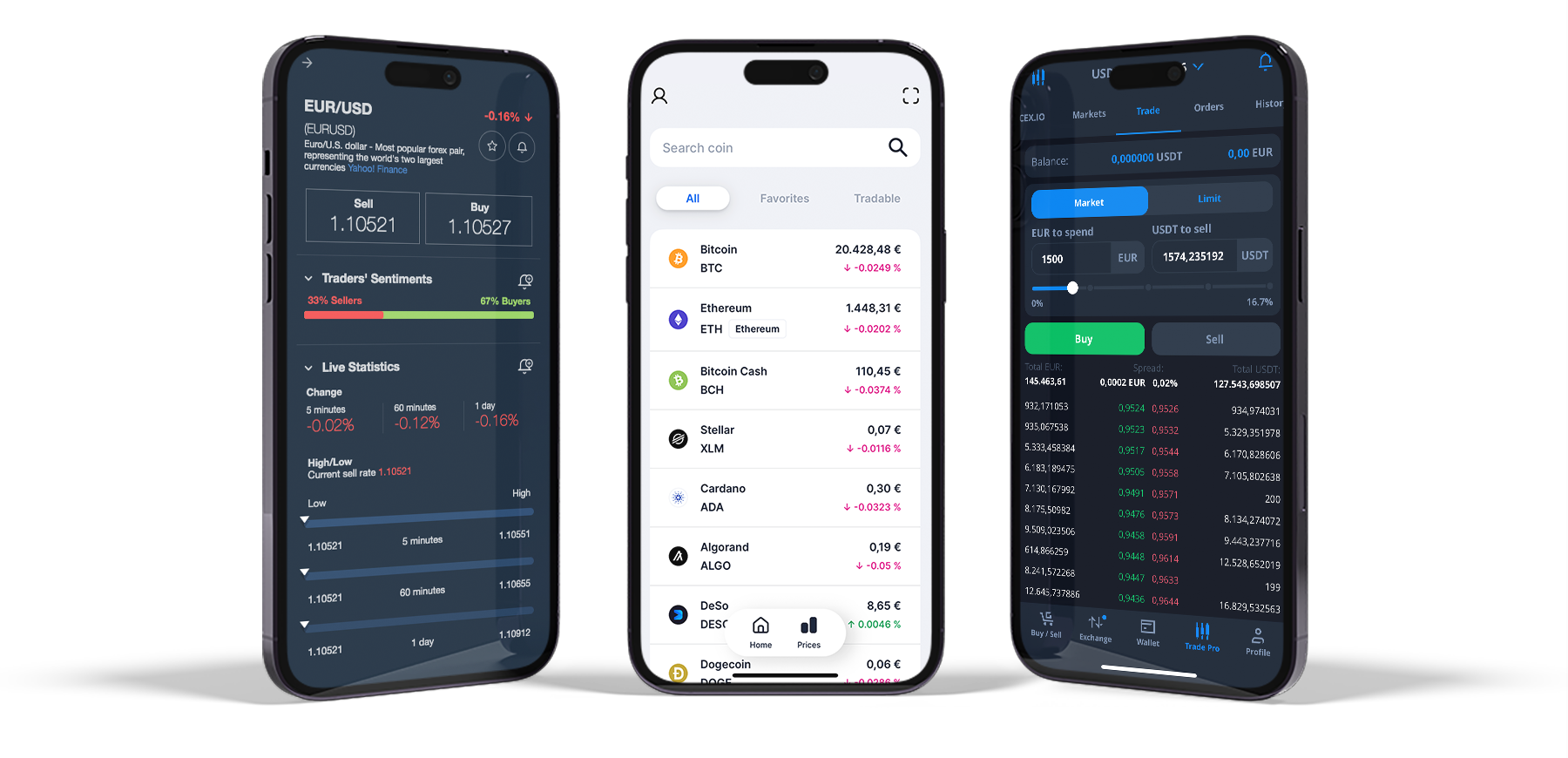

In Star Trader, currency trading occurs in pairs, wherein one currency is swapped for another.

In Star Trader, currency trading occurs in pairs, wherein one currency is swapped for another.

The forex market is the largest financial market in the world – larger even than the stock market, with a daily volume of $6.6 trillion. According to the 2019 triennial central bank survey of fx and otc derivatives markets.

Forex, or foreign exchange, can be explained as a network of buyers and sellers, who transfer currency between each other at an agreed price. It is the means by which individuals, companies, and central banks convert one currency into another – if you have ever traveled abroad, then it is likely you have made a forex transaction. While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken with the aim of earning a profit. The amount of currency converted every day can make the price movements of some currencies extremely volatile. It is this volatility that can make forex so attractive to traders: bringing about a greater chance of high profits.

Online platforms and marketplaces facilitate the trading of content for both individuals and businesses. These platforms serve as intermediaries, connecting content creators with buyers seeking to acquire or license particular types of content.

Since

2024Content that focuses on Star trader tools, software, platforms, and resources can be beneficial for traders.

These feautres will help you reach your goals.

Risk-free trades offered can vary specific criteria to be eligible.

Traders use tools like stop-loss orders to limit potential losses on a trade.

The core of the Star trader market, where large financial institutions trade currencies directly with each other.

They might offer trading ideas or suggestions based on their market knowledge and experience.

We go the extra mile to make trading easy, and rewarding.

To ensure your funds are used for trading purposes only.

Multiple deposit and withdrawal methods with zero deposit fees on most payment methods.

Spreads starting from 0.0 pips.

Institutional-level liquidity access, ensuring ultra-tight spread.

24-hours steady trading environment, with orders getting processed in milliseconds.

A 24/5 service for queries, consultation, and feedback.

Trade inspiration. Our expert team provides daily commentary and in-depth analysis across the global markets. All · Equities · Forex · Options · Bonds.

Deeo order book liquidity in all market conditions

2.7 TPS matching engine 50 micro second core latoncy

ISO/IEC 27001:2013, PCI:DSS v3.2.1. Lavel 1 complaince Cryptocurrency Security Standard

Star trader involves trading currency pairs, where one currency is exchanged for another. Each currency pair is quoted in terms of one currency relative to another. For example, EUR/USD represents the Euro against the US Dollar.

The primary goal of trading is to generate profits. Traders buy assets at a lower price and sell them at a higher price, aiming to capitalize on price movements.

Once you've chosen a broker, open a Star trader account with them.

Major currency pairs (like EUR/USD, USD/JPY) are the traded and have higher liquidity.

Ensure you have a good grasp of the market you're trading, its terminology, and how it operates.

Decide which financial market you want to trade in, whether it's Star trader, stocks, or others.

We answered questions so you don’t have to ask.

Research and choose a Star trader broker: There are numerous forex brokers available, so it's important to research and choose a reputable and regulated broker that suits your trading needs. Consider factors such as regulation, trading platform features, account types, customer support, and fees.

Standard Accounts: Standard trading accounts often have

higher minimum deposit requirements, typically ranging from $500 to $1,000

or more. These accounts are suitable for experienced traders or those who

have a larger capital base.

To provide you with accurate information, could you please specify the type of account you are referring to?

Contact your financial institution or log in to your online account: Reach out to your bank, investment firm, or online platform where your funds are held. Alternatively, you can access your account online through their website or mobile app.